If you take place to live in any one of these states, you would certainly have to pay an insurance deductible for personal injury protection as well as without insurance driver property damage, no matter what. Ensure to consult with your insurance policy firm for even more thorough information. Do you always have to spend for your deductible? Thankfully for you, you don't always have to pay an insurance deductible for your insurer to cover you.

However, if the expenses of the problems surpass the restriction of the at-fault vehicle driver's insurance coverage and you choose to run the remaining expenses via your insurance provider, you could still have to pay for the insurance deductible. On the various other hand, if you're the one liable for the accident, while you could not need to pay the insurance deductible to cover the other motorist's expenditures, you will still have to pay an insurance deductible for your insurer to cover your very own costs.

Your vehicle insurance policy deductible is the amount of cash you would certainly add when your insurance firm pays for a protected insurance claim - auto insurance. How do cars and truck insurance policy deductibles work?

Anytime you're in an automobile crash and there are damages to your vehicle that would certainly be covered under comprehensive or collision coverages, you'll be in charge of paying the insurance deductible under each of those protections. You can select various deductibles within your auto insurance policy for both crash and also thorough. If you have several vehicles on your automobile insurance coverage policy, you can also choose different deductibles for each and every automobile.

You can select various coverage limitations for all of them, in addition to set deductibles, relying on which coverage it is. Why can not you always select your deductible? Because not all protections have them as well as some, like Injury Protection, have them in some states, and also not others. Job with your insurance company to identify just how to satisfy your insurance coverage needs.

See This Report on Car Insurance Deductibles & How They Work

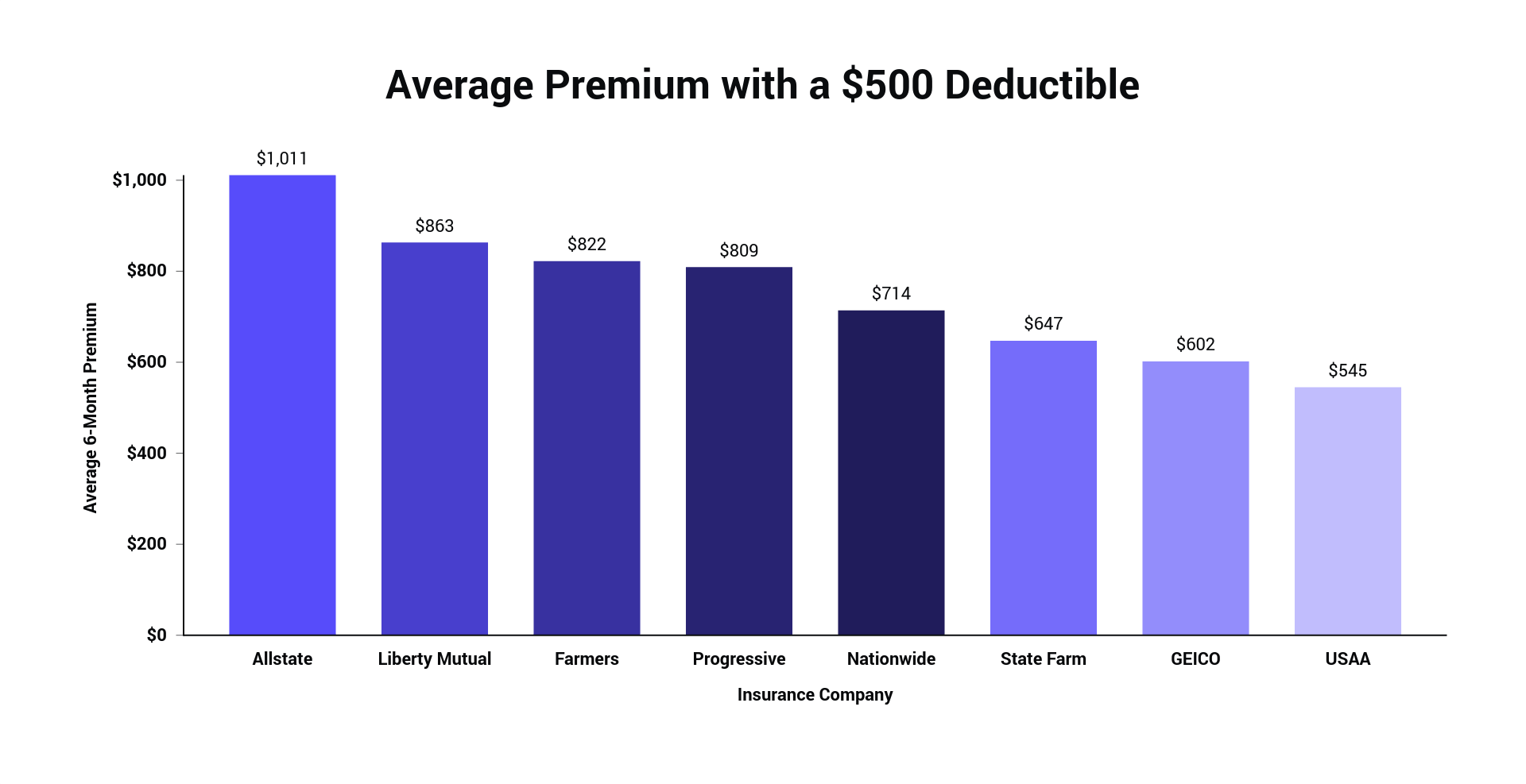

Since they aren't on the hook for as much money, they have less risk. They charge a lower cars and truck insurance policy premium. credit. In other words, a higher deductible amounts to reduced insurance coverage premiums. A reduced insurance deductible equates to higher insurance coverage costs. An example would be an insurance plan with a $500 accident insurance deductible.

This falls under crash insurance coverage. When choosing automobile insurance policy coverage, you chose the low insurance deductible of $500. The insurance company would certainly now have to pay out $9,500. However what happens if you picked a high deductible of $2,500? Then the insurance company would just have to pay $7,500. They have less threat, so you'll pay a reduced costs.

This can be danger What if like in the instance over, you chose a $2,500 deductible however really did not have that money available? When you submit an insurance coverage claim, you'll be invoiced for your insurance deductible. If you don't have that $2,500 all set to pay you could be stuck in a bind with a service center.

When it concerns auto insurance, your insurance deductible is just one of one of the most crucial elements of your policy. As well as, guess what? You have control over it. An insurance deductible is an amount you need to pay out-of-pocket prior to your insurance policy coverage kicks inand it can be different for every person. So, just how do you recognize what the best insurance deductible is for you? In this short article, we'll assist you understand what deductibles are, just how they function, and what to take into consideration when choosing your automobile insurance policy deductible.

Allow's break down the different kinds of deductibles and also what they could suggest for you. No, obligation insurance does not call for a deductible. Liability coverage is activated when you have actually been established to blame in a mishap where someone is harmed and/or their residential or commercial property is damaged. In this scenario, your obligation coverage will cover the expense sustained by the damaged person, and also there is no insurance deductible required.

Not known Facts About Should I Have A $500 Or $1000 Auto Insurance Deductible?

Insurance deductible quantities will certainly vary from one insurance coverage provider to the next, but typical deductibles are $250, $500, & $1,000. When should you submit a collision insurance coverage insurance claim? You can file a crash insurance coverage case whenever you hit another car, building, utility post, or object. When you remain in a protected accident event, your crash insurance will assist pay for the price of fixings.

Nevertheless, when one more driver is at-fault as well as strikes your automobile, things will certainly look a little various. You will certainly not have to pay any type of insurance deductible when another driver hits you. As long as the at-fault vehicle driver lugs enough insurance coverage, their obligation coverage ought to cover the expense of your repairs.

Your UMPD protection would assist pay for the problems to your vehicle. Many states need vehicle driver's bring some type of UIM coverage, while others need insurer to supply UIM insurance coverage as well as vehicle drivers can select to decline it. Without Insurance Vehicle Driver Physical Injury, If you're involved in an injury crash where the at-fault vehicle driver does not carry adequate insurance policy, your Without insurance Motorist Bodily Injury (UMBI) insurance coverage can aid cover your medical treatments, discomfort and also suffering, shed earnings, and also funeral expenses (in the unfortunate event of a death).

Whether or not this protection calls for a deductible can differ depending upon the state. If your insurance deductible is more than the price of repair services to your car, you will be accountable for covering the whole cost yourself (suvs). For instance, if your deductible is $500 and also it costs $300 to repair a damaged taillight after you backed into a fencepost, you would be in charge of paying the $300 in repairs out of pocket.

Some parts of a car insurance coverage are called for, some https://5-ways-to-save-money-on-car.us-east-1.linodeobjects.com are optional, and also others have variable elements, like the certain protection amount or the deductible you pick. These protection choices and various other rating aspects will establish the costs you pay for your auto insurance policy protection. The deductibles you choose can have a signicant effect on your insurance coverage rates, so when you are determining which deductible to select, it is necessary to take into consideration the strategy that will work best for your unique needs.

Should I Have A $500 Or $1000 Auto Insurance Deductible? Fundamentals Explained

Picking a low insurance deductible methods you pay much less cash when something occurs to your automobile, however your regular monthly payments will usually be greater. While you'll constantly intend to consider your personal scenario as well as preferences, people who select higher deductibles commonly value a lower regular monthly premium may choose to deal with little claims by themselves or may have a lower-valued automobile that they would instead change in case of a mishap.

To pick the ideal insurance deductible for you, right here are a couple of things that will be valuable to think about: If you were to select a $1,000 insurance deductible, would certainly it be challenging ahead up with the funds in the event of a crash? Everyone is different. Some people favor to take care of small repair work by themselves as well as only resort to their insurance coverage in much more expensive scenarios, while others are extra likely to file a case no matter the dimension - dui.

Or, they may decline these coverages entirely if it doesn't make monetary sense when considering the worth of their lorry - liability. When submitting a cars and truck insurance policy claim, there will certainly be specific situations that will require you to pay an insurance deductible as well as others that won't. Let's take a look at a couple of circumstances (a non-exhaustive checklist, naturally) where you 'd likely need to pay a deductible: When filing a collision insurance claim after a single-car crash; When submitting a collision claim after you are at mistake in a multi-car crash; When submitting a thorough insurance claim after an occasion besides accidents, such as theft, fire, or hail; When you're confronted with an unanticipated as well as unpleasant occasion, not having to pay an insurance deductible can feel like a massive relief.

If you chose a $0 insurance deductible automobile insurance coverage choice, no deductible would certainly be required when sending an insurance claim under that protection kind. Currently that you've obtained the lowdown on cars and truck insurance policy deductibles, exactly how to pick them, and also what options you have, how do you really feel concerning yours? At Clearcover, we're all regarding making insurance policy quick, simple, as well as very easy.

Take control of your coverage and see what you can save by switching over to Clearcover (whenever, all online).

What Does Deductible Mean In Car Insurance? - Car And Driver Can Be Fun For Anyone

What is the difference in between a deductible as well as a costs? A costs is the quantity of cash that you would certainly pay your insurer in order to keep your plan energetic. Unlike a deductible, your costs is usually paid on a regular monthly, yearly, or semi-annual basis. Your insurance deductible as well as your premium go hand-in-hand; if one is higher, than the various other will be lower therefore.

Will raising my insurance deductible really conserve me cash? The short as well as easy answer to this question is of course; if you boost your deductible, you will conserve money on your premiums.

If your deductible is incredibly high, You will certainly be accountable for paying it in complete whenever an insurance claim takes place. Having a high deductible could likewise negatively affect you in case of filing a small case (auto). If the price of damages you are applying for are much less than the expense of your deductible, it will certainly make no feeling for you to even file the insurance claim.

For instance, if you stay in a city that has a big volume of little crashes as a result of rush hour, after that a reduced insurance deductible is probably your finest choice as you might be most likely to obtain into a crash than somebody living in a reduced populated area. money.

This is so you will not need to pay such a large amount each time that you make a case. If you have a really clean driving record, having a higher deductible might be advantageous for you. Final thought: You have choices Choosing what cost to establish your deductible at can be a hard choice (risks).

Not known Facts About Car Insurance Deductibles Guide: 5 Key Things To Know In 2022

Have even more inquiries regarding your deductible, superior or various other protection options? Contact us with one of our accredited insurance policy specialists today. vehicle insurance.

Should you try to conserve cash by selecting a greater deductible or feel even more protected by going with a reduced one? To select the right deductible for you, you'll need to consider your driving background, your emergency fund, as well as the costs of different deductibles, along with a number of various other variables.

Secret Takeaways Your deductible is the portion of costs you'll spend for a protected insurance claim - cars. Consider your automobile's value, your emergency situation fund, and also the expenses of protection when selecting an insurance deductible. Choosing a greater deductible might assist you conserve money on costs, but this indicates you'll need to pay even more expense after an accident.

In some states, you may likewise have a deductible for:: Pays to fix your vehicle after damage triggered by a vehicle driver without insurance coverage or without adequate coverage. trucks.: Pays your clinical expenses when you've been harmed in an accident.: Covers the prices of some mechanical fixings, similar to a service warranty.

Whether you pay an insurance deductible after an occasion depends upon your coverage, that is at fault, your insurance provider, and also your state's legislations (affordable). In The golden state, you can qualify for a deductible waiver on your accident protection, which suggests your insurance provider will pay the insurance deductible if an uninsured driver strikes you.