With any luck you may never encounter a circumstance where you'll need to pay a deductible, but it is necessary that you be cautious to choose a plan with an insurance deductible that you can pay for to pay - affordable auto insurance. Your insurance policy agent can help you address your insurance deductible inquiries. Call Travelers for your automobile insurance coverage quote.

cheapest car money dui

cheapest car money dui

Below are 10 methods to save on your car insurance. No one suches as to spend even more money than necessary on automobile insurance policy.

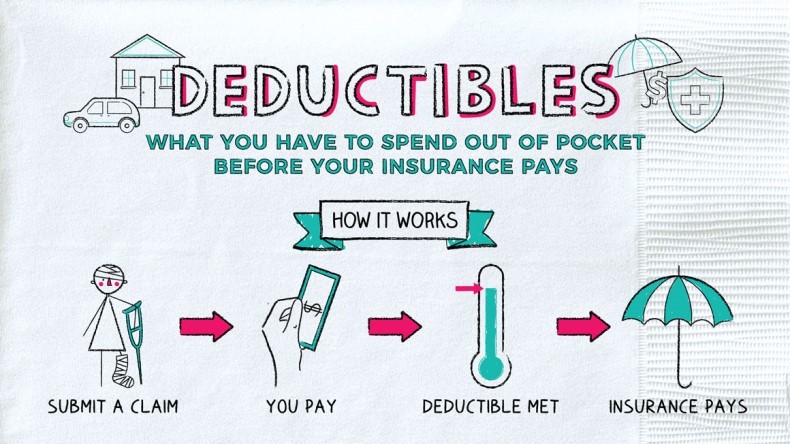

Your vehicle insurance deductible is generally a collection amount, claim $500. If the insurance policy insurer identifies your insurance claim quantity is $6,000, as well as you have a $500 insurance deductible, you will receive an insurance claim repayment of $5,500 - low cost. Nevertheless, based upon your insurance deductible, not every cars and truck crash warrants a case. If you back into a tree causing a little dent in your bumper, the cost to fix it might be $600.

Deductibles differ by policy and driver, and also you can pick your car insurance coverage deductible when you buy your policy.

Contrast quotes from the leading insurance business. Which Auto Insurance Coverage Insurance Coverage Kind Have Deductibles?, there are differing deductibles based on those different types of protection.

This coverage pays for fixings to your automobile when you are at mistake. This can be when your vehicle is harmed in a crash with one more automobile or a things such as a tree or wall surface. This insurance deductible is normally the highest deductible you will have with your vehicle insurance coverage.

Because situation, you would not pay a crash insurance deductible. Accident protection coverage pays the medical costs for the motorist and all travelers in your vehicle. Uninsured driver insurance coverage pays your costs when you are in an auto accident with a chauffeur that is at fault however does not have insurance or is insufficiently guaranteed to cover your prices.

What Is the Average Deductible Expense? Since consumers select varying types of auto insurance policy protection with various financial limits, deductibles can vary dramatically from one motorist to the next.

Also, your auto insurance deductible will certainly vary based upon that protection and also the cost of your costs. Generally speaking, if you pick a plan with a greater insurance deductible, your costs will be lower. This can be a terrific choice as long as you can pay that higher insurance deductible in case of an accident - cheaper cars.

All about Car Insurance Deductible: What Is It And How Does It Work?

In fact, you can save approximately $108 per year by increasing your deductible from $500 to $1,000 - cheap auto insurance. For those with limited budget plans, choosing a lower premium and also a greater deductible can be a means to guarantee you can pay for your automobile Click to find out more insurance coverage. Nonetheless, if you can afford it, paying a greater costs can imply you do not have to create a great deal of cash to pay a reduced deductible in case of a crash.

It's essential to have your inquiries concerning car insurance policy deductibles addressed prior to that happens, so you know what to expect. Broaden ALLWho pays a deductible in a crash?

If the at-fault motorist does not have insurance coverage or enough insurance coverage to cover the various other motorist's expenses, the no-fault driver can use his auto insurance policy as additional protection to pay the costs. When do you pay a deductible if you are called for? Normally, if you are needed to pay a car insurance deductible, the quantity of the insurance deductible will be deducted from your case settlement when it is provided.

Can you avoid paying a deductible? Essentially, the only method to avoid paying a cars and truck insurance deductible is not to submit an insurance claim.

Contrast quotes from the top insurance provider. Secret Information Concerning Auto Insurance Coverage Deductibles, If you have automobile insurance coverage, you will have to pay a cars and truck insurance policy deductible when you file a claim for repair services and also injuries. Exactly how much you spend for your deductible relies on your cars and truck insurance coverage as well as just how much your automobile insurance coverage costs is - auto insurance.

Our How Ma Auto Insurance Deductibles Work Statements

The at-fault chauffeur in the accident is usually needed to pay a car insurance deductible. Liability coverage does not call for a vehicle insurance policy deductible, yet only covers the costs of the other chauffeur, not your own. Concerning the Writer.

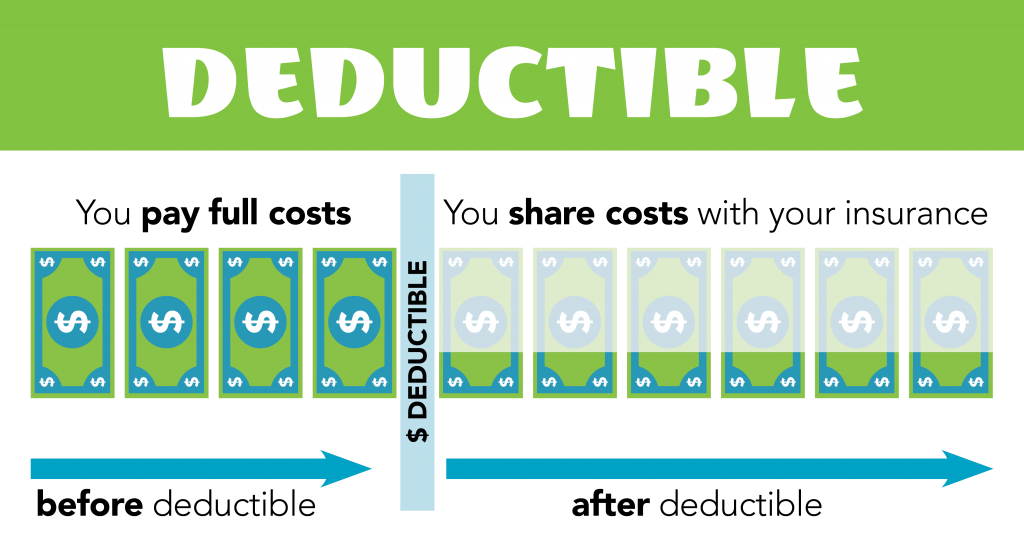

Allow's clarify just how deductibles function and just how to pick the finest one for your budget and also protection needs. Merely put, an insurance deductible is the amount of money you'll have to contribute in the direction of clearing up an insurance coverage case.

So you would certainly have to cover fifty percent of the costs ($500) of that $1000 case. Also, in a case where the damages is approximated to be $500 or much less, the whole price of repair services would certainly drop on you. Rare, there are some exceptions where an insurance deductible is non-applicable. If one more insured motorist is responsible for your problems and also injuries, a deductible does not apply.

insurance companies insurance companies low cost auto cheap insurance

insurance companies insurance companies low cost auto cheap insurance

Yet for brand-new car proprietors, the overview might not be as rosy. The average price of a brand-new automobile is approximated to be $37,000, which results in greater costs (cheap auto insurance). If you drive a new vehicle and are entailed in a major crash, it can trigger thousands in damage (let alone the possibility for individual injury) or amount to the car.

For vehicle drivers with a high insurance deductible, the bulk of the repair costs would certainly drop on them. Stacking Insurance deductible, Prior to signing on the dotted line for your policy, you should verify exactly how each circumstance is dealt with. The reason is that several insurance policy packages might have different deductibles, which are collective. This is called a "piling deductible," as well as the ideal way to portray exactly how this functions is with an example: Allow's claim you were driving a vehicle with 3 other travelers as well as got struck by an uninsured driver (vehicle).

All about High Or Low Car Insurance Deductible - Compare.com

However, your deductible is set at $1000, as well as the agreement mentions it is used individually. This implies you would certainly need to contribute towards automobile repair services and the medical expenses of every traveler. affordable car insurance. For this factor, always ensure your deductible is bundled in as lots of conditions as possible to avoid situations of this nature.

Understandably, the probability of being associated with an incident rises the more time you invest behind the wheel. The a lot more you drive, the reduced the insurance deductible must be to help guarantee minimal losses in the event of a mishap. auto. Nonetheless, if you're just placing in a few thousand miles annually, picking a greater insurance deductible can save you money on your premium expenses, and also this distinction might be able to assist contribute if a mishap does ever take place.

While a deductible may not use if you were not the chauffeur responsible, it doesn't always secure you in situations where the responsible vehicle driver is underinsured or uninsured (credit score). The choice you make on your deductible cost should be a matter of individual preference. The expense of an insurance policy premium scales with the insurance deductible, so finding the equilibrium boils down to evaluating your budget and threats of having a mishap.

While raising your insurance deductible will certainly lower your premium, there are other effects to think about for your car insurance policy costs. Allow's take a look at all the factors you ought to take into consideration when picking your auto insurance deductible!

If you weren't needed to have a deductible, you could technically have as several mishaps as you desired on the insurer's dime. Paying an insurance deductible guarantees you additionally have a risk in any type of claims you make. Deductibles usually only relate to damage to your very own residential property, like whens it comes to comprehensive and also accident car insurance policy. insurance affordable.

Indicators on What Is A Car Insurance Deductible? – Forbes Advisor You Should Know

cheaper auto insurance affordable auto insurance cheaper car cheap auto insurance

cheaper auto insurance affordable auto insurance cheaper car cheap auto insurance

What is the connection in between the insurance deductible as well as costs? Usually, a reduced deductible ways higher month-to-month settlements. If you have a reduced insurance deductible, you have more insurance coverage from your insurer and also you need to pay much less expense in the situation of a case. A greater insurance deductible implies a minimized price in your insurance coverage costs.

A reduced insurance deductible of $500 implies your insurance provider is covering you for $4,500. A greater deductible of $1,000 suggests your business would after that be covering you for only $4,000. Considering that a lower insurance deductible equates to a lot more protection, you'll have to pay more in your monthly premiums to balance out this boosted protection.

This was reliant upon the state, however, where Michigan only saved 4% for the deductible raising while Massachusetts conserved approximately 17%. Some people make the mistake of selecting the highest insurance deductible simply to save cash on their costs. In the situation of an occurrence, however, having a high insurance deductible could have serious financial consequences.

If you have that money handy at any kind of point, it could be worth choosing a higher insurance deductible. accident. 2. What is the payback? Do the mathematics with your insurance representative. Just how much would certainly you minimize a lower costs if you had a higher deductible? Would certainly you conserve cash that would correspond to that deductible when it comes to an event? For instance, lets say that transforming from a $500 to $1,000 deductible would save you 10% on your yearly costs.

Currently you have a raised insurance deductible by $500, yet you are conserving $80 annually. That implies you would certainly require just over 6 years in order to compose the distinction. If you do not enter into an accident in those 6 years, the enhanced deductible was worth it. Otherwise, you need to pay more out of pocket.

Little Known Questions About What Are Auto Insurance Deductibles & How Do They Work?.

If you have a great driving record, a greater insurance deductible can work in your favor. You'll conserve cash on the costs, which you can utilize towards your deductible in the instance of an insurance claim. A driver that hasn't had a mishap in 20 years may not be terrified by the above example of the 6-year time duration to make up the distinction. affordable car insurance.

Ultimately, a higher insurance deductible is a greater danger. The lower your deductible, the a lot more coverage and also protection you have. If you do not obtain in a great deal of mishaps, you can take the threat with a greater deductible.

There are other methods to reduce your premiums, like looking around as well as bundling your auto and house insurance coverage. Click here to find out about the 16 ways to lower your auto insurance premium. If you couldn't manage to make your insurance deductible tomorrow, you require a lower deductible. If you're an excellent driver with a high resistance for threat, you can elevate your insurance deductible.

If you could not afford to make your deductible tomorrow, you require a reduced deductible. If you're a good vehicle driver with a high tolerance for danger, you can increase your insurance deductible.